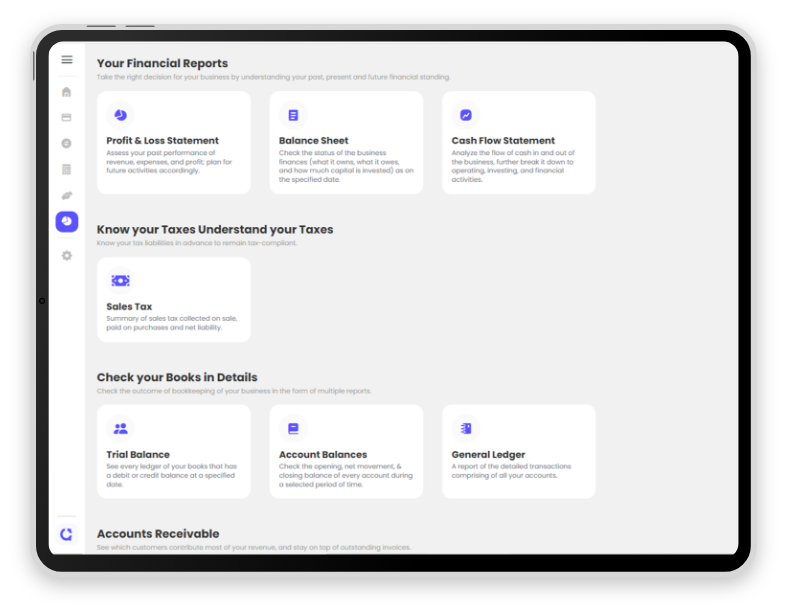

Remember in the transaction analysis, our final accounting equation was: Assets $88,100 (Cash $66,800 + Accounts Receivable $5,000 + Supplies $500 + Prepaid Rent $1,800 + Equipment $5,500 + Truck $8,500) = Liabilities $200 + Equity $87,900 (Common Stock $30,000 + Net Income $57,900 from revenue of $60,000 – salary expense $900 – utility expense $1,200). As you study about the assets, liabilities, and stockholders’ equity contained in a balance sheet, you will understand why this financial statement provides information about the solvency of the business. The other two statements are for a period of time. A balance sheet is like a photograph it captures the financial position of a company at a particular point in time. Notice how the heading of the balance sheet differs from the headings on the income statement and statement of retained earnings. That specific moment is the close of business on the date of the balance sheet. The balance sheet, lists the company’s assets, liabilities, and equity (including dollar amounts) as of a specific moment in time. The Ending balance we calculated for retained earnings (or capital) is reported on the balance sheet. Net income from month (from income statement)ĭividends (or withdrawals for non-corporations) Next, we subtract any dividends declared (or any owner withdrawals in a partnership or sole-proprietor) to get the Ending balance in Retained Earnings (or capital for non-corporations) Metro Courier Inc. We start with beginning retained earnings (in our example, the business began in January so we start with a zero balance) and add any net income (or subtract net loss) from the income statement. The statement of retained earnings, explains the changes in retained earnings between two balance sheet dates. Statement of Retained Earnings (or Owner’s Equity) The net income from the income statement will be used in the Statement of Equity. When expenses exceed revenues, the business has a net loss. Net income is often called the earnings of the company. Expenses are costs of doing business (typically identified as accounts ending in the word “expense”).

Together they represent the profitability and strength of a company. Thanks to GAAP, there are four basic financial statements everyone must prepare .

Financial statements are how companies communicate their story.

0 kommentar(er)

0 kommentar(er)